Real Estate Test (Canada) iOS

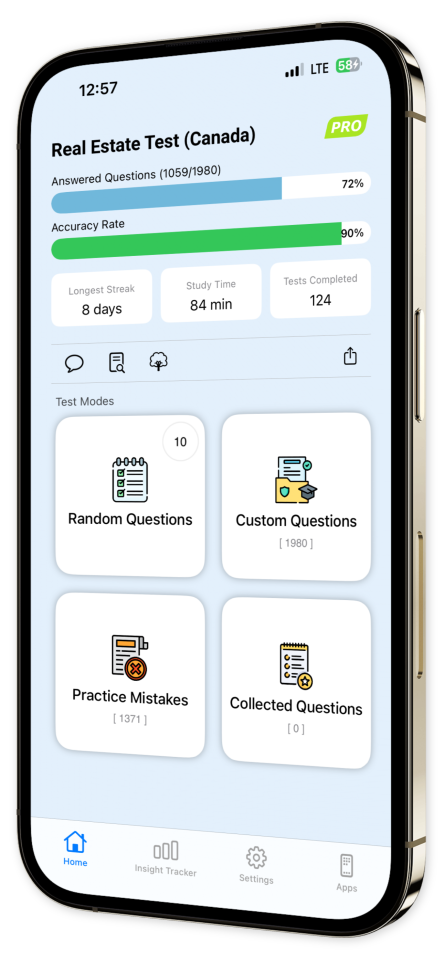

Unlock your potential in the Canadian real estate market with Real Estate Test (Canada)!

Our app is meticulously crafted to immerse you in a realistic exam environment, providing an extensive suite of practice questions tailored specifically for Canadian Real Estate professionals.

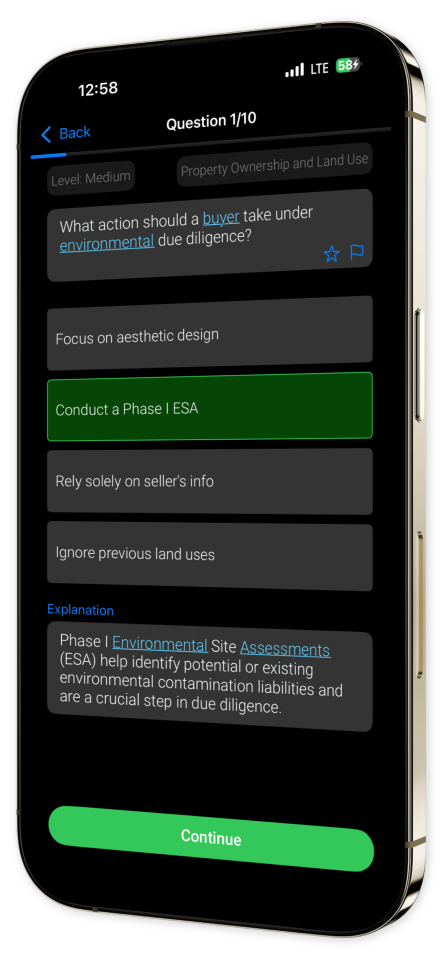

Each query is meticulously curated with elaborate explanations, ensuring you grasp the essentials needed to excel in your certification process.

Key Features:

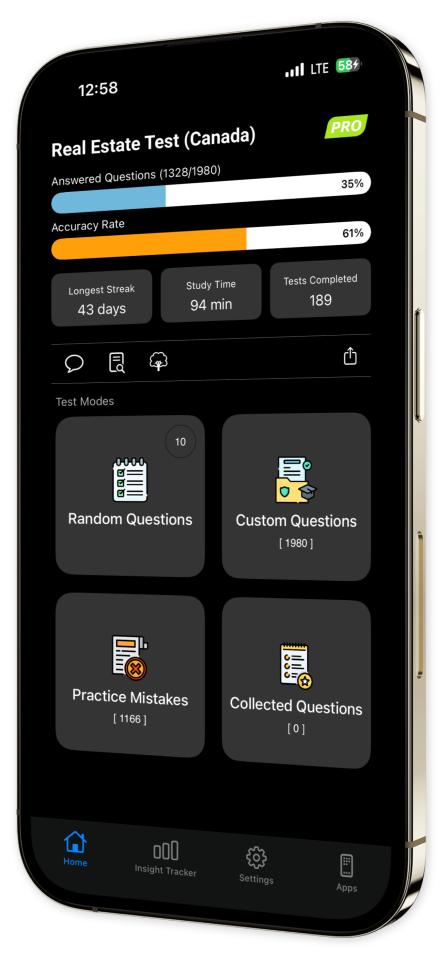

Extensive Question Bank: Master the nuances of Canadian real estate with hundreds of carefully constructed practice questions covering core subjects.

In-Depth Explanations: Delve deeper with comprehensive insights from every question, enriching your learning and bolstering your retention.

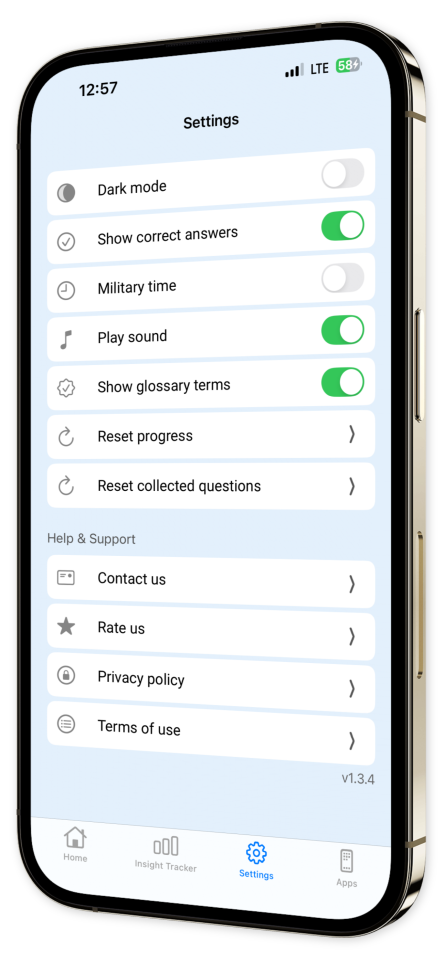

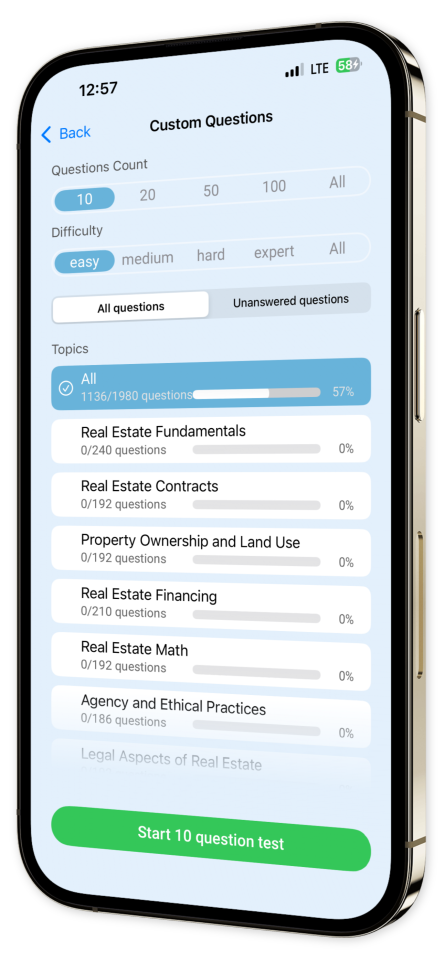

Customizable Quizzes: Tailor your preparation by constructing personalized quizzes targeting specific areas or topics, aligning with your unique study needs.

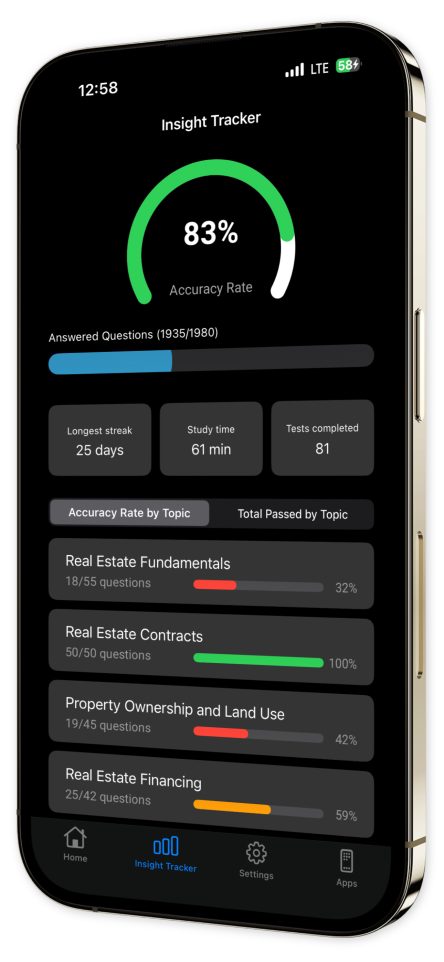

Progress Tracking: Monitor your advancement with our intuitive progress tracking tools, supporting continuous improvement and focus on weak points.

Offline Access: Empower your study sessions with the convenience of offline access, ensuring seamless learning at any place and any time.

User-Friendly Interface: Navigate with ease through a sleek and intuitive design that keeps your focus on acing the exam material.

Download Real Estate Test (Canada) today and embark on a journey of efficient and targeted exam preparation.

Capitalize on a smarter way to achieve remarkable success in your Canadian Real Estate career!

Transform your study habits, enhance your understanding, and make your dream of certification a reality in record time.

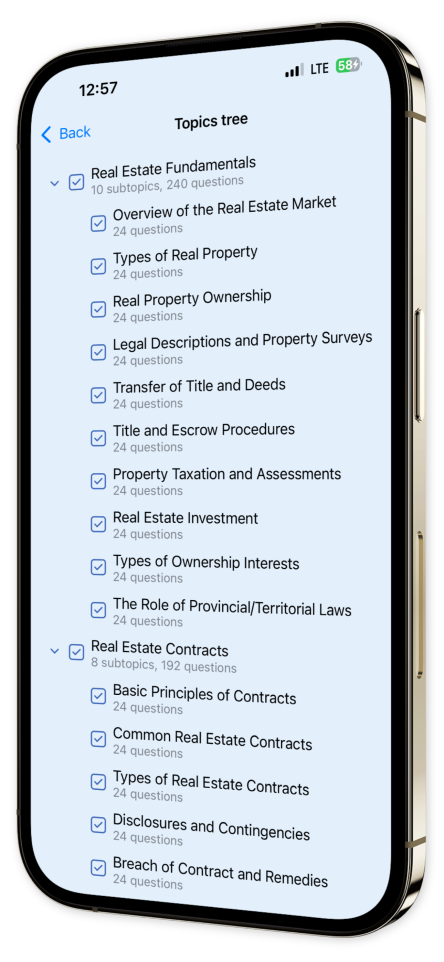

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

What is the main purpose of an open house in real estate?

To evaluate market priceTo attract buyersTo increase property taxesTo renovate the property

An open house aims to attract potential buyers by allowing them to view the property without an appointment.

Which term describes a real estate market with more buyers than properties?

Seller's marketBuyer's marketNeutral marketBalanced market

A seller's market occurs when demand exceeds supply, often resulting in higher prices and increased competition among buyers.

What is the role of a real estate agent?

To sell carsTo repair housesTo facilitate property transactionsTo manage hotels

Real estate agents help buy, sell, or rent properties by providing market insights, negotiating prices, and handling transactions.

Which factor most influences Canadian real estate prices?

Property taxesEmployment ratesSchool qualityNearby shopping centers

Employment rates affect housing demand, impacting prices due to increased buyer ability.

In Canadian real estate, what does MLS stand for?

Mortgage Loan SystemMain Listing ServiceMultiple Loan SchemeMultiple Listing Service

MLS stands for Multiple Listing Service, a database used by real estate agents.

Calculate the annual property tax if the rate is 1.25% on a $400,000 home value.

$5,000$4,500$7,000$6,000

1.25% of $400,000 is $5,000 (0.0125 * 400,000 = 5,000). Verified by repeating calculation.

What is the impact of a 75 basis point interest rate hike on a $500,000 mortgage with 25 years amortization?

$75,000 increase$54,500 increase$108,000 increase$57,000 increase

Basis points affect mortgage rates non-linearly. Calculating exact impact requires amortization formulas; typically, a 75 basis point increase significantly affects payments, often estimated around $54,500.

Which factor most directly influences the capitalization rate in real estate investments?

Age of propertyLocation desirabilityInterest ratesProperty size

Interest rates directly influence capitalization rates as they affect the opportunity cost of investing in property versus other investments.

An investor seeks a 7% yield on a $1.5M property. What annual rental income is needed?

$95,000$105,000$100,000$110,000

To reach a 7% yield, calculate the rental income by multiplying desired yield by property value: 0.07 * $1,500,000 = $105,000.

How does a 20% land transfer tax rebate affect a $40,000 tax in a transaction?

$8,000 savings$10,000 savings$6,000 savings$12,000 savings

A 20% rebate on a $40,000 tax is calculated as $40,000 * 0.20 = $8,000. Therefore, an $8,000 savings is realized.